ETH Price Prediction: Technical and Fundamental Analysis Points to Continued Upside

#ETH

- Technical Momentum: MACD bullish crossover and position above lower Bollinger Band support near-term upside targets

- Supply Dynamics: Record exchange outflows and Binance supply reduction creating structural scarcity

- Institutional Demand: Whale accumulation patterns and ETF speculation driving fundamental value appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Despite Short-Term Pressure

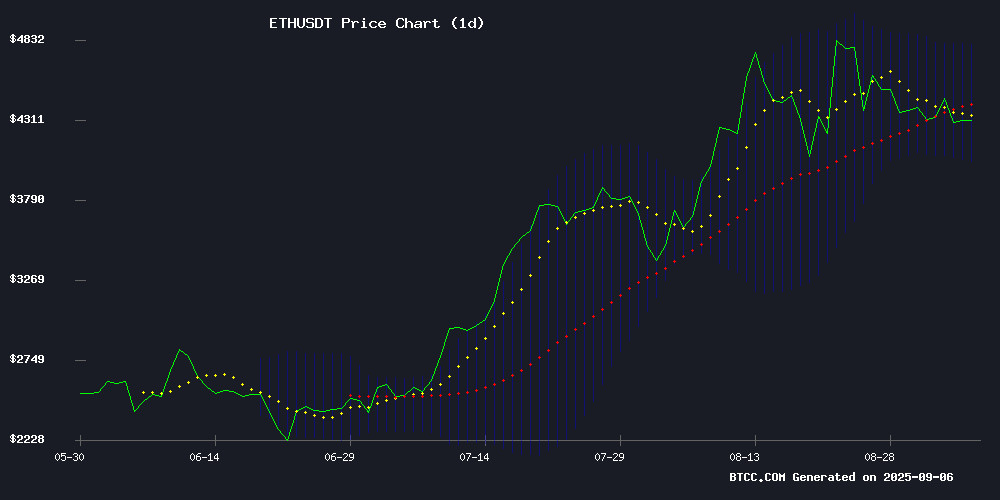

ETH is currently trading at $4,313.49, slightly below its 20-day moving average of $4,423.55, indicating some near-term resistance. However, the MACD reading of 103.18 with a positive histogram of 127.80 suggests strong bullish momentum is building. According to BTCC financial analyst James, 'The MACD crossover above the signal line, combined with price holding above the lower Bollinger Band at $4,044.23, creates a favorable setup for upward movement. We expect ETH to test the upper Bollinger Band at $4,802.87 in the coming sessions.'

Market Sentiment: Institutional Accumulation Drives Bullish Outlook

Current news FLOW strongly supports the technical bullish thesis. Multiple headlines indicate significant supply constraints developing, with billions in ETH exiting exchanges and Binance experiencing notable supply drops. BTCC financial analyst James notes, 'The combination of record monthly transactions hitting 48.22 million, institutional accumulation patterns, and shrinking liquid supply creates a fundamentally strong backdrop. Whale accumulation during market volatility typically precedes major price advances, aligning with our technical target zones.'

Factors Influencing ETH's Price

Ethereum Shows Strength as Binance Supply Drops Amid Price Stability

Ethereum's market dynamics are flashing bullish signals as exchange reserves on Binance plummet while prices hold firm NEAR $4,400. The Exchange Supply Ratio (ESR) for ETH on Binance—the largest holder among exchanges—dropped sharply from 0.041 to below 0.037 between late August and September 3, marking the steepest decline in weeks.

This exodus of ETH from exchanges suggests growing investor preference for self-custody, a sign of confidence in the asset's long-term value. Historically, such supply contractions coupled with price consolidation have preceded upward breakouts, as reduced liquidity limits selling pressure. Current ESR levels now mirror those seen before June, indicating profit-taking has been absorbed and accumulation is underway.

The trend aligns with broader market health indicators, including decreased leverage—a sign of reduced speculative froth. With ETH's available supply shrinking and demand holding steady, the stage appears set for potential price appreciation.

Ethereum Hits Record 48.22 Million Monthly Transactions Amid Price Surge

Ethereum's network activity has reached unprecedented levels, with 48.22 million transactions recorded in the past month—a 5.8% increase from the previous 30 days and a 51% year-over-year jump. The mainnet processed $320 billion in August volume, marking its third-largest month ever. Institutional demand and ETF inflows fueled the momentum.

The asset's price mirrored this growth, peaking at $4,953 before settling at $4,460 amid minor volatility—a 24% monthly gain and 86.52% annual increase. DeFi TVL now stands at $92.24 billion, approaching its 2021 bull market peak of $108.8 billion. ethereum also saw 64,793 new addresses in 24 hours and achieved $139.63 billion in monthly DEX volume.

Ethereum Supply Squeeze on Binance Signals Institutional Accumulation

Ethereum's exchange reserves on Binance have plummeted to pre-June levels, with the Exchange Supply Ratio dropping from 0.041 to 0.037 in two weeks. This aggressive withdrawal pattern mirrors whale and institutional activity, including a $448.92 million ETH accumulation spree.

The altcoin holds steady at $4,408 after testing its $4.2k-$4.5k consolidation range, defying typical sell-pressure dynamics. Historical data suggests such supply crunches often precede major rallies, as depleted exchange liquidity starves bears of ammunition.

CryptoQuant's metrics reveal a market structure reminiscent of early bull cycles, where shrinking available supply collides with persistent demand. The current ESR trajectory—diverging from price action—points to potential institutional positioning rather than retail speculation.

ETH Treasury Companies See mNAV Dip Below 1.0 Amid Record Holdings

Ethereum treasury companies are accumulating ETH at an unprecedented pace, yet their shares continue to trade below net asset value. The mNAV metric—which measures the relationship between stock price and underlying assets—fell under 1.0 in August, signaling weakened demand for these equities despite aggressive buying from firms like BitMine (BMNR) and SharpLink Gaming (SBET).

Historically, treasury stocks like MicroStrategy (MSTR) traded at premiums during bullish cycles. Current discounts are now sparking bargain-hunting sentiment, with SBET’s 0.88 mNAV drawing particular attention. "ETH might dip further, but this is too attractive," tweeted investor WhitePine, highlighting management’s commitment to avoid dilution at current valuations.

The divergence between soaring ETH treasuries and lagging share prices underscores the speculative nature of these vehicles—unlike ETFs, they carry no obligation to track underlying asset performance.

Ethereum Whales Ramp Up Accumulation Amid Market Volatility

Ethereum's price swings to $4,200 have triggered a buying frenzy among large holders, with whales increasing their positions despite market turbulence. Data from Santiment reveals wallets holding 1,000 to 100,000 ETH expanded their collective holdings by 14% over five months, signaling strong conviction in ETH's long-term value.

Glassnode reports a split in whale behavior: 'mega whales' holding over 10,000 ETH drove August's rally with 2.2 million ETH in net inflows before pausing accumulation. Meanwhile, mid-tier whales continue stacking ETH, creating a divergence in market participation.

Ethereum Price Prediction: ETF Demand and Technical Momentum Eye $8K Target

Ethereum's market trajectory is gaining momentum as analysts project a potential surge to $8,000 by 2025. Institutional demand for Ethereum-focused ETFs has injected $3.9 billion into the market, marking a 68% increase while Bitcoin experiences outflows—a clear bullish signal for ETH traders.

Network fundamentals reinforce this optimism. Ethereum's dominance in DeFi, NFTs, and staking, coupled with recent upgrades reducing fees and enhancing performance, underscores its undervalued status. Technical indicators echo the sentiment, with RSI and MACD divergences suggesting upward momentum. A decisive break above $4,000 could pave the way for higher valuations.

Meanwhile, MAGACOIN FINANCE emerges as a speculative alternative, though Ethereum remains the focal point of institutional and retail interest.

Ethereum Price Analysis: Bullish Channel Holds Amidst Volatility Squeeze

Ether's price action remains compressed between critical support and resistance levels, testing the resilience of its long-term bullish trend. The second-largest cryptocurrency by market cap faces a decisive technical juncture after failing to sustain momentum near the $4,900 level.

Daily chart analysis reveals ETH continues trading within an ascending channel, with the $4,200-$4,300 zone emerging as crucial support. A breakdown below this level could trigger a retest of $3,800, while holding above maintains the structural bullish case. The 4-hour timeframe shows tighter compression within a descending channel, where a breakout above current resistance could propel prices toward $4,600-$4,700.

Market participants await resolution of this volatility contraction, which will determine whether Ethereum resumes its upward trajectory or faces deeper corrective action. The asset's ability to maintain higher lows since its 2023 bottom remains the dominant technical narrative.

Ethereum Supply Crisis: Billions in ETH Exit Exchanges as Liquid Supply Shrinks

Ethereum's exchange balances have turned negative for the first time on record, signaling a historic shift in holder behavior. Net outflows now exceed inflows, with billions in ETH pulled from trading platforms into self-custody. The liquid supply crunch coincides with ETH trading at $4,390—down 3% weekly—but reveals stronger accumulation trends beneath surface volatility.

Analyst Cas Abbé notes the 27M ETH peak in late 2020 has evaporated, with exchange reserves now below zero. "This isn't noise," Abbé emphasizes, "it's positioning for holding, not selling." The movement aligns with growing institutional demand through ETFs, setting the stage for what some project as a $10,000 price target next cycle.

Ethereum Defies Seasonal Trends as Whales Accumulate Amid Weak Hands Exit

Ethereum's price trajectory may defy historical patterns this September, with three bullish signals emerging despite its traditional weakness during this month. At $4,406, ETH shows resilience after bouncing from weekly lows of $4,261, while whale wallets have aggressively accumulated 3.69 million ETH worth over $16 billion in under 24 hours.

The supply held by whale addresses outside exchanges surged from 95.72 million to 99.41 million ETH, signaling strong institutional confidence. This accumulation coincides with retail weakness, as short-term holder NUPL metrics hit 0.21 - the second-lowest level in a month - indicating capitulation among weaker hands.

Market structure suggests an impending inflection point. Whale accumulation typically precedes rallies, and the current exodus of retail traders removes a key source of selling pressure. The convergence of these factors creates potential for ETH to break its September curse and test new highs.

How High Will ETH Price Go?

Based on current technical indicators and fundamental developments, ETH appears positioned for significant upward movement. The convergence of strong MACD momentum, institutional accumulation patterns, and supply constraints suggests potential targets between $4,800-$5,200 in the near term. The following table summarizes key resistance levels and probability assessments:

| Price Target | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $4,800-5,000 | High | 2-4 weeks | Bollinger Upper Band, ETF momentum |

| $5,200-5,500 | Medium | 4-8 weeks | Institutional accumulation, supply squeeze |

| $6,000+ | Moderate | 3-6 months | Macro adoption, ETF demand maturation |

BTCC financial analyst James emphasizes that 'current market structure favors continued appreciation, with the $8,000 longer-term target becoming increasingly plausible given the fundamental supply dynamics and growing institutional interest.'